In order to provide cashless, paperless, and faceless medium to pay taxes on time, and also due to falling in the smart cities list, Muzaffarpur Nagar Nigam has started collecting the holding tax online.

So far, citizens owning a property in the city, doesn’t matter whether it is residential or commercial, paying their property tax via offline medium.

The same has now been changed to online. Citizens can now pay their property tax by visiting the official website of Muzaffarpur Smart City Limited.

Before diving into the exact steps to pay property tax online, let me first tell you some prerequisites for it.

There are some documents you should keep handy before paying your property tax online.

Muzaffarpur Property Tax Pay Online – Prerequisites Documents

- Holding Receipt

- Pan Card

- Aadhaar Card

- Electricity Bill

- Land Documents

- Sale Deed

Once you have these documents handy, follow the steps given below to pay your property tax online.

How to Pay Muzaffarpur Nagar Nigam Holding Tax Online?

The Muzaffarpur Municipal Corporation has started taking property tax online through this portal.

If you are new to this portal, you have to first create an account in it.

Registration Part

To do so visit this link. It is basically a form where you have to fill in different details that are associated with your property.

While you can easily fill all the fields in the form, you might be thinking what to fill in the User ID.

Well, in the User ID field, you have to create a username for yourself. For example, if your name is Ramam, you can create a memorable username like Ramankr and so on. If the User ID is available then you can proceed filling all the other details available in the form.

After filling out all the details, click on the Sign Up button and as soon as you do it, the portal will send you the confirmation message on both your registered mobile number and email.

Keep a note of your User Id and Password at some safe place for future usage.

After successfully completing the above steps, you have created an account on this portal. And, now it’s time to login to the account and start paying or verifying your property tax online.

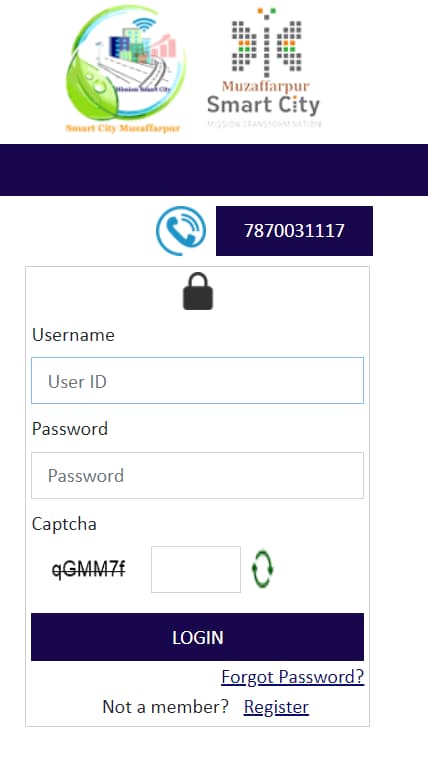

To do so visit this link and fill out your User ID, Password, and Captcha Code shown and then click on the submit button.

Login Part

After login, users can see all of their properties in the dashboard. If the portal is not showing your property it means your property has not been updated by the officials yet.

For now give it some time as the portal is completely new, give it around 1 month of something. Anyway the last to pay your property tax online for this assessment year i.e. 2023-24 is October 1. After that, a 1.5% penalty would be charged each month.

Once your property starts showing in the dashboard, you can then click on Property Tax Bill > View Bill in the left sidebar of the portal.

From there on users have to fill the asked details and then can pay the bill online.

While generating the bill, you can see that the officials are charging you 1000 for water usage charge. Well, back in 2022, the state government started taking water usage charge from citizens.

Now, what should you do if your property will not appear in the dashboard even after a month or something. I suggest you first consult any of the concerned officials of the department and then start the registration of your property online via the method I am explaining below.

How to Register Your Property Online (Only for Muzaffarpur Citizens)?

After successfully creating and logging to the account via the steps I explained above, click on Property Tax > New Property Registration in the left sidebar.

A form will open called SAS Form I.

Fill out this form carefully and then upload the documents I told you to keep handy, which are:

- Holding Receipt

- Pan Card

- Aadhaar Card

- Electricity Bill

- Land documents

- Sale Deed

Once done, click on the next button and you can take the print out of this filed form.

Now, this form will be sent to the counter clerk for verification, then it will further be verified by Tax collector, Tax Inspector, and lastly Municipal Commissioner.

Once all these officials will verify your documents, then your property will start appearing on the dashboard.

Then, you can pay or view your property tax bill online.

That’s it for this article. We will be constantly updating this article once we receive any new update in the portal or any new information. If you face any difficulty or have any query regarding this topic, feel free to post it in the comments down below.

Looking forward to hearing from you!